List of

Articles

Stocks and Investing

Stocks I Own

Stock Advice

Weight Loss and Fitness

Sports

Donate

Back to Home

|

Fundamental Analysis for Short Term Gains

The use of technical and fundamental analysis is vital to many investors in terms of finding a stock which is both cheap relative to its financial numbers and theoretical value. While such techniques are used commonly to differentiate between a stock which may be bullish or bearish, theoretically using such analysis, especially technical, typically yields a form of capital gain or loss which is widely different from the investor's prediction. While such tactics may be utilized in a more useful manner when looking at long term potential, in dealing with the short run, finding a stock which can yield high capital gains is going to be more of game of chance rather than skill.

To validate such a hypothesis, from the research I have conducted which looked at an aggregate of both low and high cap equities in numerous different sectors, I saw no clear indicators which stood out when wanting to determine such a prediction.

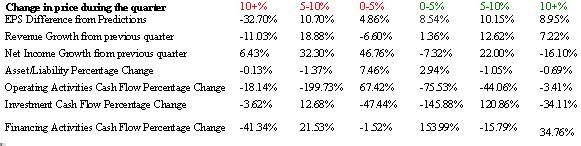

When looking at the table, I complied how each indicator may have influenced the quarterly change of each stock by creating an average of the stocks I researched. Each change in price relative to its quarter had no less than five quarters to base the information from and limited some of the data to avoid aberrations such as a 5000% increase in operating margins as an example. While it can be said that there were increases in terms of EPS margins and revenue growth, the statistics have no defining average or trend from one quarterly growth or decline to another and confirms my notion that technical analysis is more suited for long term goals rather than short term ones.

Looking at such information poses wide questions of how potentially the best values of the so called indicators are found in the -5 to -10 percent range when many investors would agree such indicators should be posed for creating growth and capital gains rather than mediocre capital losses during a quarter. While such an assumption may be arguable, such indicators are more inclined to have a greater effect in the long run rather than the short run. Thus, investors should take such information seriously if they are willing to be patient with the stock because clearly in the short run there is no clear cut answer of what values an investor should look at to make the best decision when purchasing a stock.

As there is always going to be more indicators which probably have a greater effect on a stock during a quarter juxtaposed to fundamental displays such as macroeconomic news or the potential for new rumors, the best advice I would give potential investors who are looking for a quick profit is to resort to your instincts. Try to use your logic of how the market may react to incoming economic news and base that logic with the beta of the company you want to buy. By completing such an action you as an investor will probably have a better understanding of your capital gains relative to just looking at the unpredictable fundamental indicators.

-Dennis Biray

July 30, 2006

©2006 BirayNetworks. All Rights Reserved

|